AML Compliance Made Simple

Risk Rater helps New Zealand businesses effortlessly comply with new anti-money laundering regulations through our affordable, easy-to-use customer risk rating platform.

Compliant with NZ's Phase 3 AML regulations

Launching June 2025 - be prepared early

Save 20-30 hours of compliance work annually

Designed for New Zealand accountants, lawyers, and real estate agents

Powerful Features, Simple Interface

Our platform provides all the tools required to meet the enhanced customer risk rating mandate under the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (Phase 3).

Configurable Risk Rating Engine

Set custom rules to score client risks based on NZ AML/CFT typologies like client type and transaction patterns.

Evidence Capture Form

Secure form to enter client details and upload proof documents, linking everything to risk scores.

Secure Record Storage

Encrypted storage for all risk ratings and evidence for the required 5-year period with downloadable compliance reports.

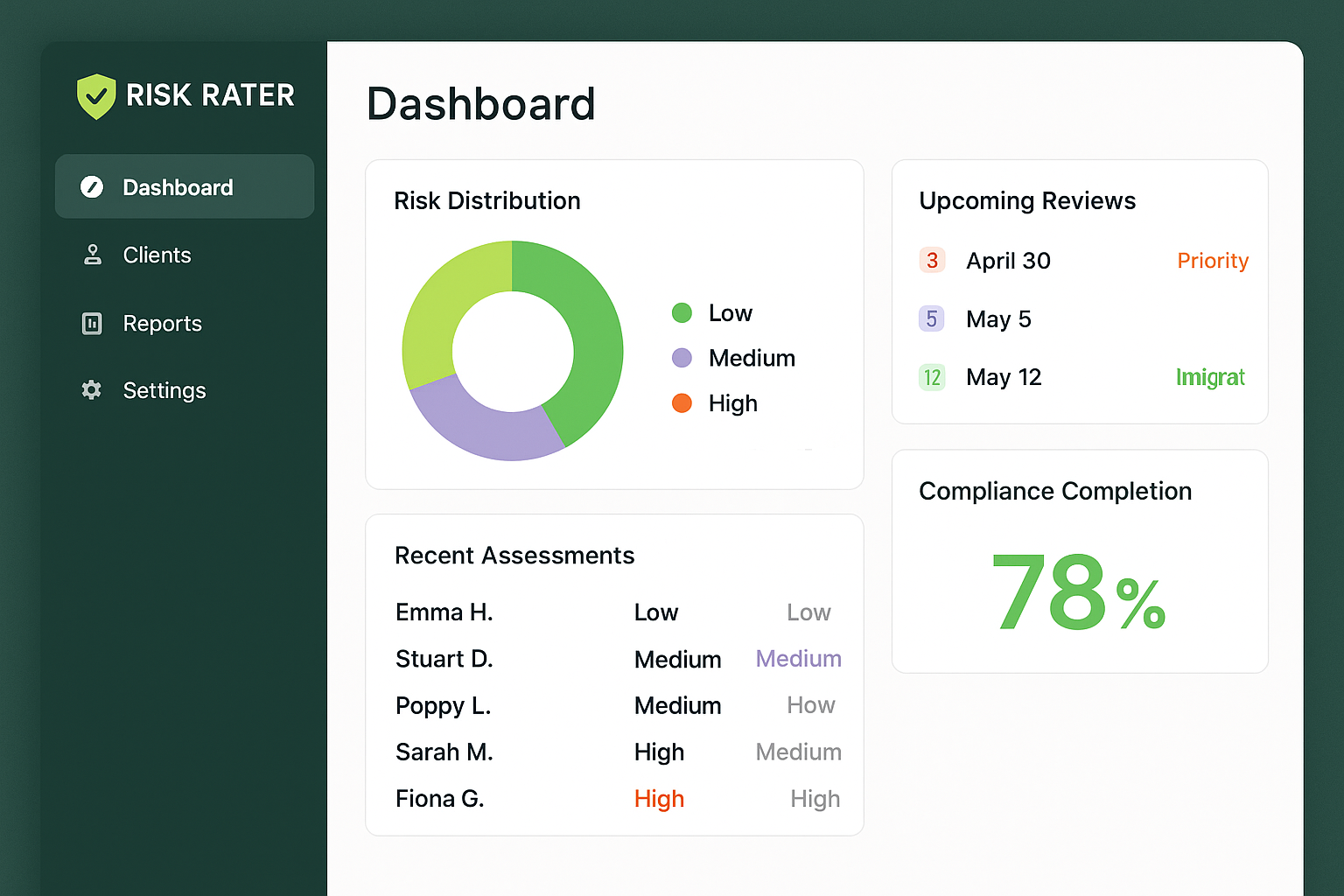

Compliance Dashboard

Get an overview of rated clients, pending reviews, and deadline alerts to stay on top of your compliance obligations.

Basic Tech Risk Module

Assessment checklists and templates to evaluate risks of new technologies with exportable reports for compliance.

The Challenges Small Businesses Face

Without Risk Rater

Understanding complex AML regulations requires expertise most small businesses lack

Manual risk assessment processes are time-consuming (20-30 hours/year)

Non-compliance can lead to severe penalties from regulatory authorities

Most AML compliance tools are too expensive for small businesses

How Risk Rater Helps

Simplified risk rating aligned with New Zealand's specific AML/CFT regulations

Automated processes save time and reduce human error

Built-in compliance features ensure you meet all regulatory requirements

Affordable pricing designed specifically for small to medium-sized businesses

The June 1, 2025 compliance deadline is approaching faster than you think!

Try Our Free Interactive Tools

What Our Customers Say

Hear from businesses across New Zealand who have simplified their AML compliance with Risk Rater.

"Risk Rater has simplified our AML compliance process tremendously. What used to take hours now takes minutes, and we're confident we're meeting all regulatory requirements."

"As a small accounting firm, we were worried about the cost and complexity of AML compliance. Risk Rater provided an affordable solution that's easy to use and meets all our needs."

"The customer support team at Risk Rater has been exceptional. They've helped us customize the platform to our specific requirements and are always available when we need assistance."

"We evaluated several compliance solutions, but Risk Rater stood out for its intuitive interface and comprehensive features. It's been a game-changer for our compliance program."

Pricing

All plans include a 14-day free trial. No credit card required.

Frequently Asked Questions

Find answers to common questions about Risk Rater and AML/CFT compliance.