AML/CFT Guides

Comprehensive resources to help you understand and comply with New Zealand's anti-money laundering regulations.

Essential AML/CFT Resources

Our team of compliance experts has created these guides to help New Zealand businesses understand their obligations under the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Act. These resources are particularly helpful for businesses preparing for the Phase 3 requirements effective June 2025.

AML/CFT Basics

Understanding the fundamentals of AML/CFT compliance

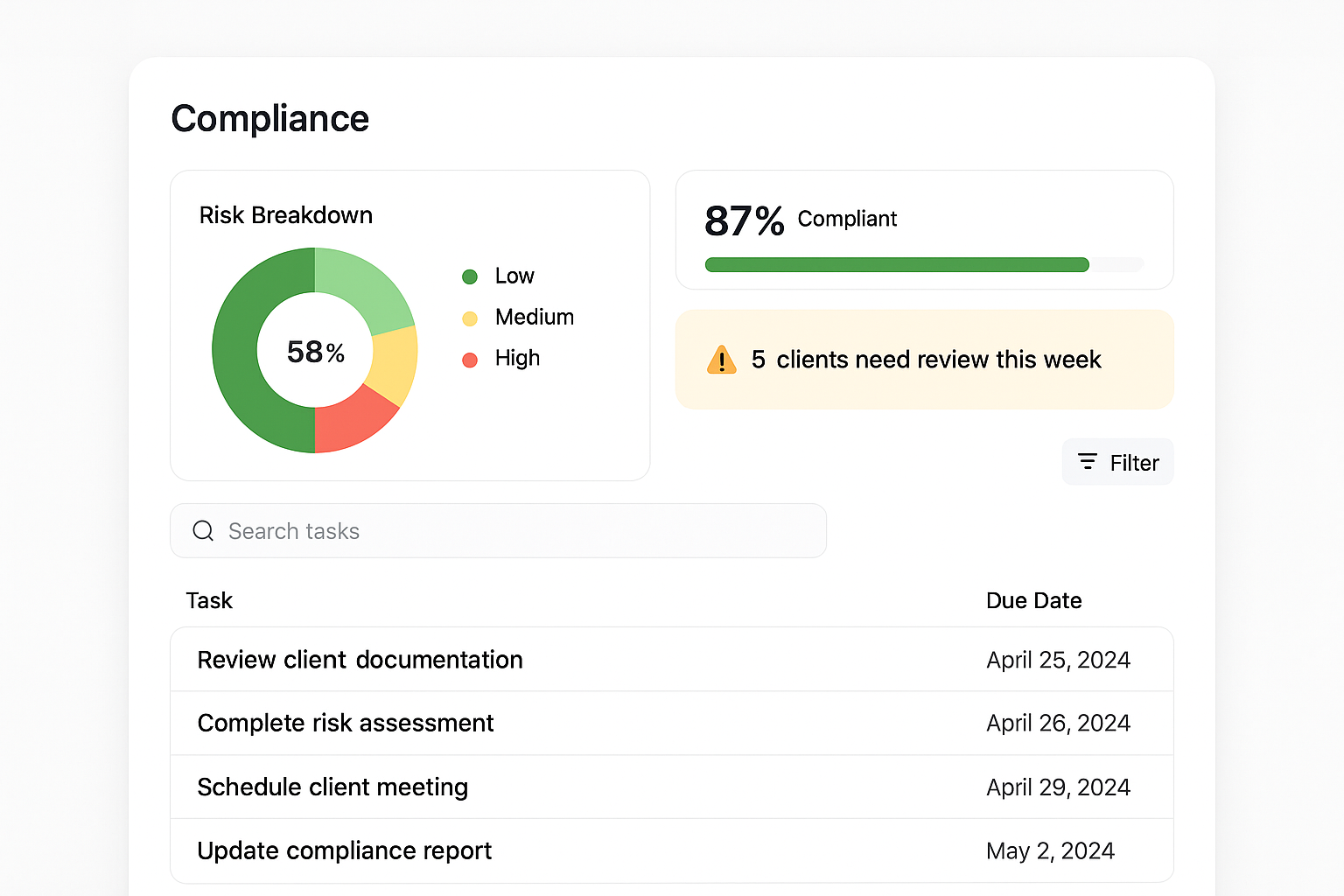

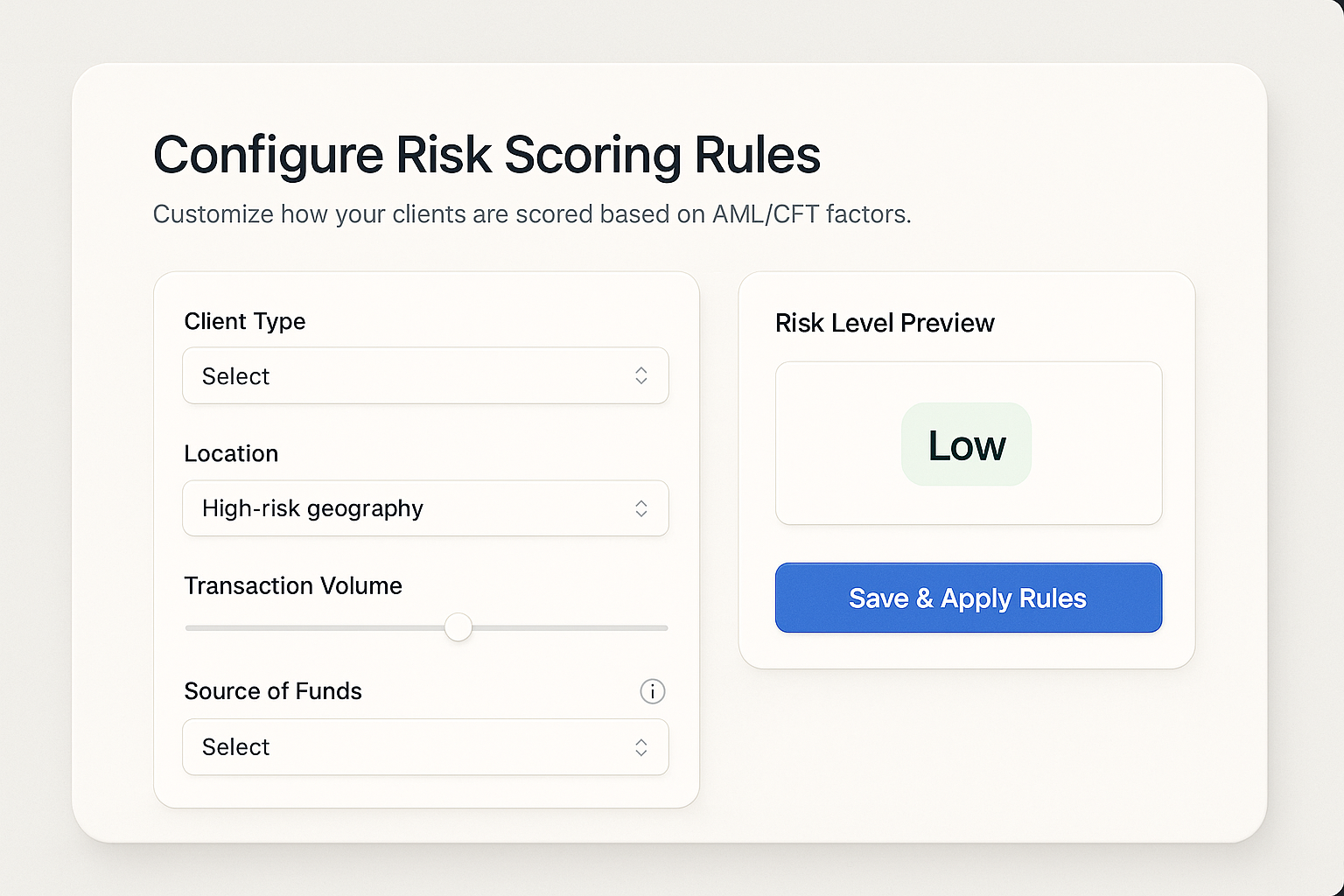

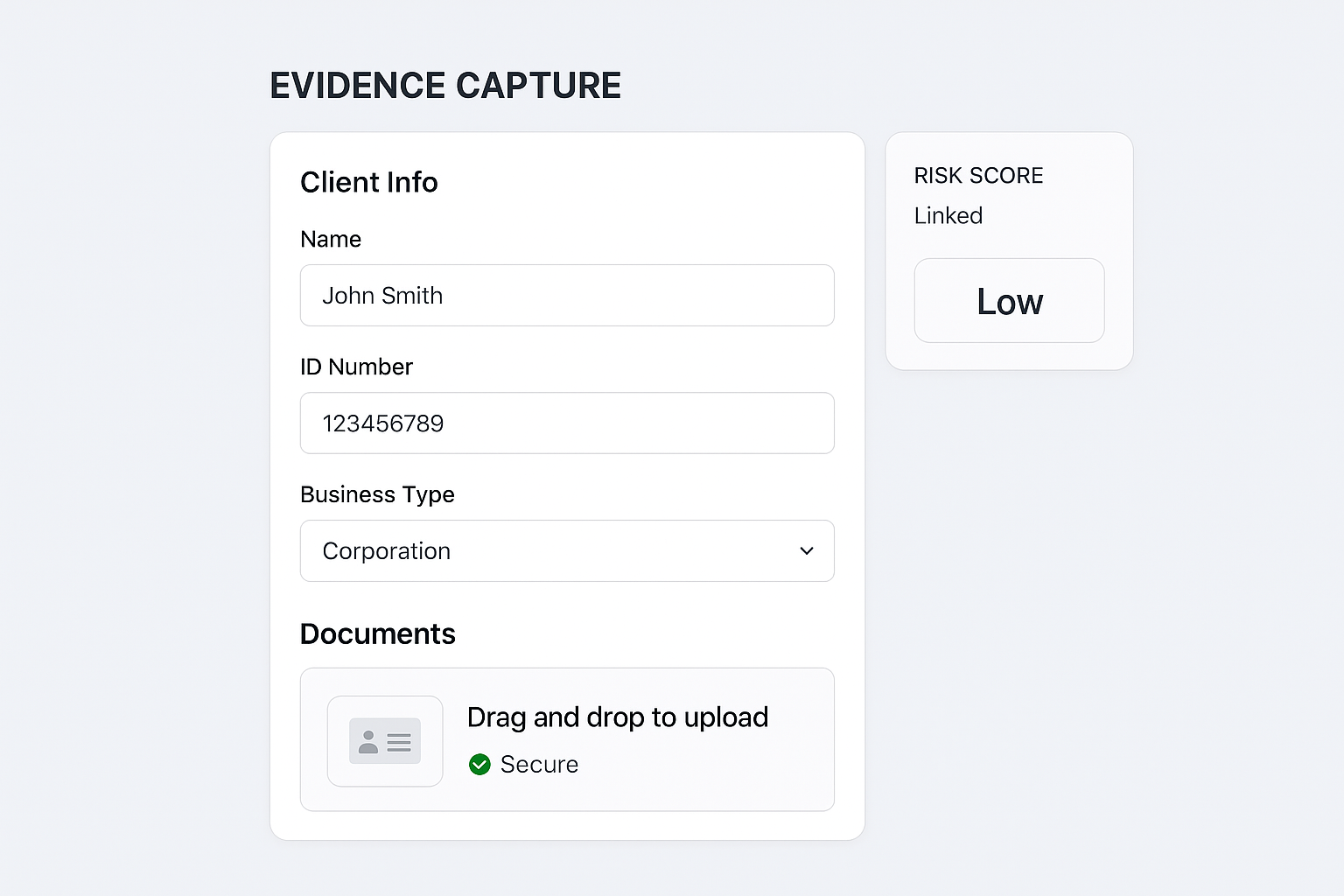

Customer Risk Assessment

Implementing effective risk rating procedures

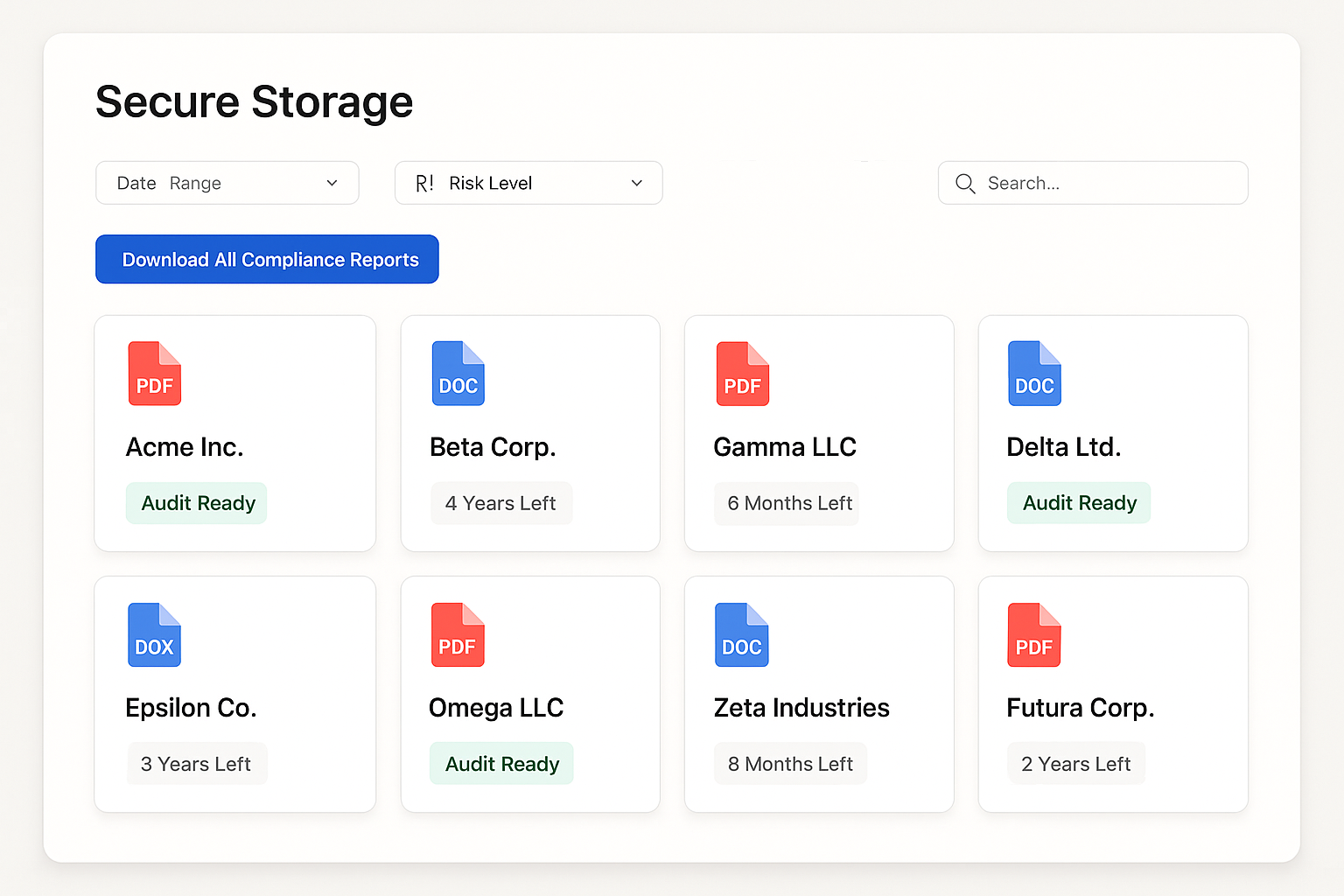

Compliance Templates

Ready-to-use templates for AML/CFT compliance

Official Resources

Links to government and regulatory resources